Worried about a mounting CGT bill? There’s a way you could halve it

Speculation continues over whether the new government might increase the rate of capital gains tax (CGT).

Of course, nothing will be known for certain until the Budget in October – but, according to the press, many wealthier investors and landlords are selling investments and properties now, so that their gains may be taxed at the current, possibly lower, CGT rate.

If you too are looking to dispose of assets and worry about a mounting CGT liability – there’s a way you could halve that bill under the current rules.

HMRC offers generous tax breaks – including reliefs you could apply against your CGT bill – as an incentive for experienced investors to take the risk of backing dynamic young UK companies, an important engine of the economy.

This article looks at the most generous tax reliefs: up to 50% savings on income tax and CGT – reserved for backing the smallest, youngest (and hence highest-risk) startups under the Seed Enterprise Investment Scheme (SEIS).

We illustrate how the CGT reinvestment relief works – and how you could apply it to this or last year’s tax bill. We also highlight one of our Featured SEIS funds, Startup Funding Club SEIS Fund, which is targeting pre-Budget deployment for applications received by 16 August.

Tax rules can change, and benefits depend on circumstances. This is a brief outline based on current rules: there are detailed conditions and rules you should consider carefully before investing. Decisions should be based on the investment merit, not the tax reliefs alone.

Important: tax rules can change and benefits depend on circumstances. SEIS investments are high risk and only for experienced investors. You should not invest money you cannot afford to lose. The minimum holding period to retain the tax reliefs is three years and the investment must remain qualifying. This is a simplified explanation of complex rules: if in doubt, please seek specialist advice.

Capital Gains Tax – in a nutshell

CGT is normally due on profits from the sale of certain assets if they exceed an annual tax-free allowance. As recently as the 2022/23 tax year this allowance was £12,300; for 2024/25, the allowance is just £3,000.

If you’re a higher- or additional-rate income taxpayer:

- 24% CGT now applies to gains from residential property that’s not your home

- 20% CGT applies to gains from most other assets

Different rates apply to some other gains, such as carried interest.

How you could save up to 50% on your CGT bill: investing in SEIS

Whether you already have a CGT liability, or expect to have one in the near future, you may be able to cut it in half when you invest in SEIS-qualifying companies – this is known as Reinvestment Relief.

How could SEIS Reinvestment Relief work in practice?

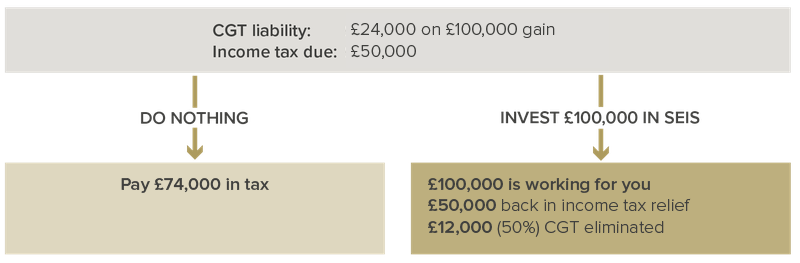

Imagine you have a £100,000 taxable gain from selling a second home(so, a £24,000 CGT liability if it was sold this tax year, and potentially more if sold the previous year when the rate was 28%) and a £50,000 income tax bill.

If you invest the full gain of £100,000 in SEIS, you could claim up to £50,000 back in income tax and £12,000 (half of the CGT bill) in CGT Reinvestment Relief.

This means instead of paying a total tax bill of £74,000, you could have £100,000 invested at an effective cost of as little as £38,000, once you take all the available tax reliefs into account.

SEIS Reinvestment Relief at a glance – an example

For illustrative purposes only. Assumes you are a higher or additional-rate taxpayer and have already used your CGT-free allowance. The 24% rate of CGT currently applies to residential property: other chargeable gains might incur a rate of 20%. Tax rules can change and benefits depend on circumstances.

To claim Reinvestment Relief you must have claimed the SEIS income tax relief in the same tax year. So, in the above example, to claim full relief on the £24,000 CGT bill, you would first have to claim the £50,000 income tax relief in the same tax year. If you were to invest less than the full gain, the CGT relief available is calculated pro rata. The maximum you can invest in SEIS with tax relief is currently £200,000 per tax year.

Carry back – apply the relief to this or last year’s tax bill

A feature called “carry back” gives you the option to offset the SEIS relief against your previous year's income tax and CGT bill – so you could potentially get back tax you've already paid.

In practice, if you use both current and previous years’ allowances, you could potentially invest up to £400,000 in one go. Remember, though, to use Reinvestment Relief you must claim the income tax relief in the same tax year as the gain, so you couldn’t use last year’s allowance against a gain this year.

Other SEIS tax advantages include: tax-free growth, loss relief, and IHT relief after two years – read more on SEIS tax relief.

Tax advantages of SEIS – an overview

- Up to 50% income tax relief

- Up to 50% capital gains tax relief

- Tax-free growth

- Loss relief

- IHT relief after two years when held upon death

If you have any questions on SEIS or another investment matter, please get in touch.

You can email us or call us on 0117 929 0511. We're open from 9am to 5.30pm Monday to Friday.

Featured SEIS fund targeting pre-Budget allotment: Startup Funding Club SEIS

To help make tax planning easier for investors, Startup Funding Club SEIS Fund has launched a special £1 million tranche, targeting deployment by 4 October 2024 – ahead of when the Budget is expected to take place (note: that date has not yet been announced).

The first deadline for this pre-Budget tranche is 16 August. Investors are expected to receive a portfolio of c.15 companies – deployment timings and size of the portfolio are not guaranteed.

The fund is run by SFC Capital (previously Startup Funding Club), one of the most active seed investors in Europe. SFC has invested in nearly 500 companies and achieved some notable successes, such as Cognism, a machine-learning driven marketing platform (partial exit generating a 39.9x return).

Overall, the fund has achieved 13 full or partial exits to date, returning £3.8 million to investors, from investments costing £0.87 million. Past performance is not a guide to the future; there have also been failures, as is to be expected when investing in very early-stage companies – see detailed fund performance.

Performance of Startup Funding Club SEIS per £100 invested in each tax year

Source: SFC, as at April 2024. Past performance is not a guide to future performance. The chart shows realised returns (where share proceeds have been returned to investors as cash) and unrealised returns (where cash has not yet been returned and the value of the investments is based on the manager’s own valuation methodology). There is no ready market for unlisted shares. The figures shown are net of all fees and do not include any income tax relief or loss relief.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.

Startup Funding Club SEIS Fund

Learn more about Startup Funding Club SEIS Fund – its manager, strategy, risks, what type of companies it invests in, the manager’s performance record, charges and our view.

Read more and see how to apply